By Andy Young

The Australian wine sector recorded increases in the average purchase price of winegrapes and its overall crush this year, according to the Vintage Report 2016 released today by Wine Australia, the Winemakers’ Federation of Australia and Wine Grape Growers Australia.

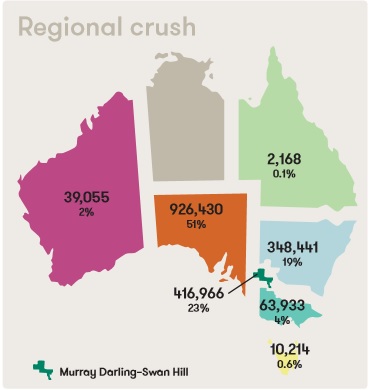

The regional crush ammounts for Vintage 2016

In what many in the sector were calling a sensational vintage for Australian fine wine, this year saw an increase of six per cent in the national crush to an estimated 1.81 million tonnes.

The report also shows that the average price paid for wine grapes grew by 14 per cent to $526 per tonne across Australia, the highest average price since 2009.

The increase in the weighted average purchase price was supported by an increase in the amount of fruit sold in the top graded categories of above $1500 per tonne.

Wine Australia Chief Executive Officer Andreas Clark told TheShout that it is encouraging to hear reports of outstanding quality translated into an increase in the average purchase price.

"In the last 12 months, we’ve seen Australian wine exports grow to $2.11 billion and the strongest growth has been in wines of $10 or more per litre FOB. This increased enthusiasm for our fine wines internationally is helping to support a stronger demand for premium fruit in Australia," Mr Clark said.

"The positivity for Australian fine wine is resonating within our key export markets and we’ll continue working closely with our grape and wine community to increase the demand and the premium paid for Australian wine."

The report shows that the amount of premium fruit sold for more than $1500 per tonne increased to account for seven per cent of the total crush this year.

Premium Shiraz in the top graded categories of more than $1500 per tonne rose to 13 per cent of the variety’s total crush and the national average price per tonne for Shiraz increased by 14 per cent.

Similarly, premium Cabernet Sauvignon in the top categories grew to nine per cent of the variety’s crush and its national average price increased by 17 per cent.

Overall, the average price paid for red wine grapes increased 13 per cent to $651 per tonne and white wine grapes grew 12 per cent to $398.

Winemakers’ Federation of Australia CEO Tony Battaglene said that Vintage Report 2016 shows that the weighted average price has increased over the last two vintages.

"It’s not uncommon to see peaks and troughs across vintages due to different factors such as fluctuations in demand. However, this year, there is an increase in pricing for the second consecutive year and an increase in the overall crush, which is encouraging. We need to remain pro-active as a sector to continue to grow demand, particularly in our key export markets of the United States and China," Mr Battaglene told TheShout.

Vintage Report 2016 shows that the average purchase prices for winegrapes increased across most Australian wine regions. The warm inland wine regions increased eight per cent to $313 per tonne and cool/temperate regions grew four per cent to $1,196 per tonne.

Wine Grape Growers Australia Executive Director Andrew Weeks said the increase in average prices is a positive development for the Australian grape and wine community.

"There is still much work to do, but with recent improvements in key markets and firming in wine grape prices across the nation, there is reason for cautious optimism. It is vital that this positive trend continues and that all in the wine sector are focused on continuing to build demand in key markets."

The crush decreased overall in warm inland wine regions, with a two per cent increase in the Riverland offset by a two per cent decline in Murray Darling–Swan Hill and four per cent decline in Riverina.

The overall national increase in the crush came from growth in many cool/temperate wine regions, including a 57 per cent increase from Langhorne Creek, 27 per cent in Tasmania, nine per cent from Margaret River, and two per cent from King Valley.

The data for the Vintage Report 2016 was collected by Wine Australia through the Wine Sector Survey 2016 and gathered responses covering an estimated 88 per cent of the crush. The report provides price dispersion read-outs and average purchase prices for varieties in more than 40 Australian wine regions.