By Vanessa Cavasinni, editor Australian Hotelier

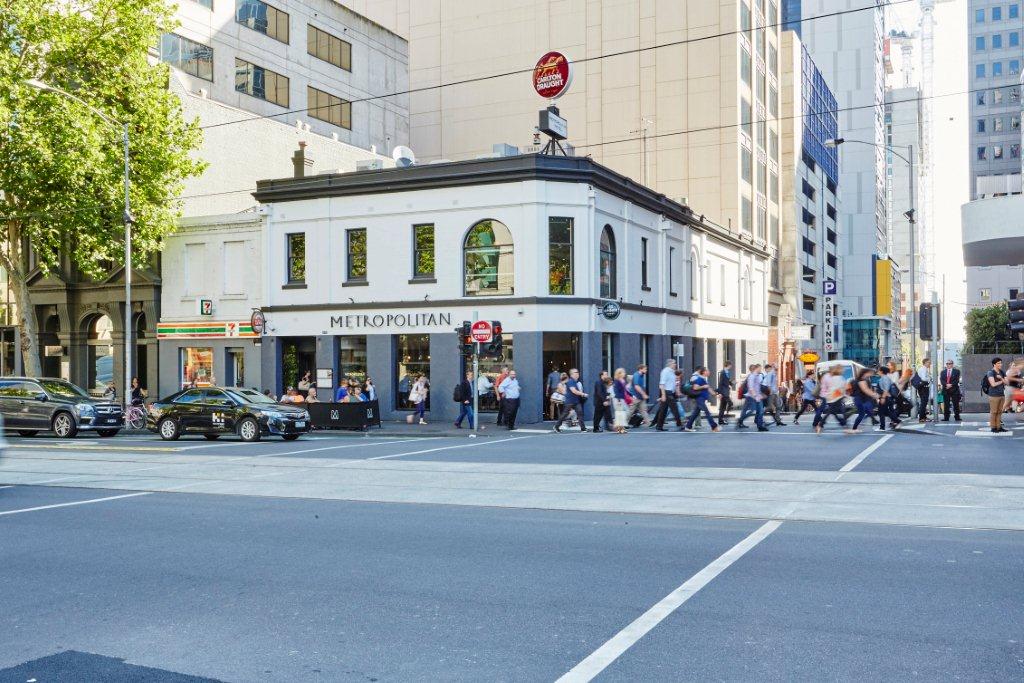

The Metropolitan Hotel in Melbourne’s CBD has been sold to a local investor for $8.61 million.

The sale price was set at a packed auction, with a 200 strong crowd in attendance. The sale of the CBD hotel was overseen by CBRE’s Josh Rutman, Mark Wizel, Paul Tzamalis and Scott Callow in conjunction with Killen Thomas agent David Marks. It was the first time in over 20 years that the iconic corner pub was for sale.

Strong interest in the hotel sale is a sign of the gathering momentum in the Melbourne pub market.

“With nine bidders competing on the day, many being multiple CBD owners, the appetite for well-located corners in the city is evident. Despite the short lease on the property and limited development potential, buyers have clearly recognised that these corners are in very short supply and are willing to bid aggressively when they come up for sale,” said Rutman.

The Metropolitan is the second CBD hotel to sell since the beginning of April after the Great Western Hotel on King Street was sold for $6.5 million earlier this month. The Metropolitan sale saw a yield of 2.38 per cent, while the Great Western Hotel sale return was even higher at 2.9 per cent.

Lazaros Papasavas – the owner of several CBD venues and one of the underbidders for the Metropolitan Hotel, commented: “We've been very encouraged by the activity and growth in the CBD market over the last 12-18 months, and as experienced owners of CBD real estate for over 40 years and seeing the appreciation in this asset class first-hand, we are continuing to actively seek out high quality CBD freeholds.”

CBRE Senior Director Mark Wizel believes all signs point to increasing property values in Melbourne.

"The cost of debt is low, confidence is improving both from consumers and tenants and this is having a very positive effect on investor sentiment.

"We thought it would be a long time for properties to consistently trade in the CBD on yields below 5 per cent. It has come a lot quicker than expected and we think that it is here to stay as supply of sub $20 million assets in the Melbourne CBD continue to be limited."