By Andy Young

New data from Roy Morgan Research has highlighted that cider is Australia’s fastest growing alcoholic beverage and that its consumption spikes dramatically during the summer months.

The research shows that between 2006 and 2016 the number of Australian adults who drink cider in an average four weeks shot up by a massive 600 per cent from 337,000 to 2,349,000. By comparison over the same period the spirits category saw 25 per cent growth, off a much larger base, going up from 3,890,000 to 4,861,000 drinkers per four weeks.

Norman Morris, Industry Communications Director, Roy Morgan Research, said: “Since we first revealed cider’s popularity boom in the wake of the government’s increased tax on [RTDs], its upward trajectory has been nothing short of remarkable.

"The number of Aussie adults drinking cider in an average four weeks has now well and truly surpassed those drinking alcopops in the same period (2,025,000) and shows no sign of plateauing. In fact, with summer upon us, Roy Morgan data shows that cider consumption is on the verge of its annual spike."

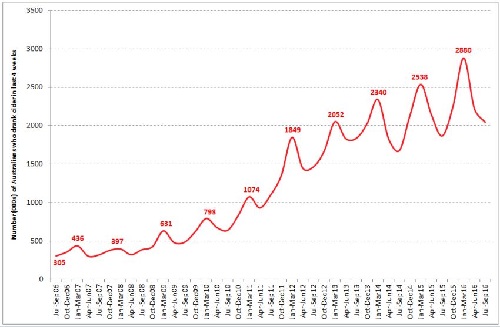

That summer spike is demonstrated in the chart below, which shows that between January and March 2016, nearly three million people (2,880,000) reported having consumed cider at least once in the last four weeks, compared with 2,250,000 in the quarter preceding it (October-December 2015) and 2,220,000 in the quarter following it (April-June 2016).

Number (000s) of Australians who drank cider in the last four weeks

This pattern is evident for all January-March quarters over the last 10 years. The chart also shows that with each consecutive summer quarter, the number of people partaking in peak-season cider consumption increases in accordance with the beverage’s overall upward trend.

In terms of brands, the Roy Morgan data shows that Somersby is the most popular, with around 724,000 Australian adults drinking the brand in an average four weeks. Strongbow comes in second, ahead of 5 Seeds, with Rekorderlig and Bulmers completing the top five.

Morris added: “With more cider options available than ever, it’s crucial that big brands don’t rest on their laurels simply because the beverage’s popularity is at such a historic high. Increased choice means increased competition, and the shifts among the most popular brands over the last 12 months are testament to this. During this short period, for example, Somersby has shot up to top spot, while Strongbow has made a comeback and last year’s favourite, 5 Seeds, has slipped to third.

“What’s more, Roy Morgan data shows that cider drinkers have an elevated tendency towards novelty, whether that be in the form of new experiences or new alcoholic beverages, which would make maintaining consumers’ interest for any length of time a little more challenging for brands.

“Of course, with the help of Roy Morgan’s deep alcohol data, brands can gain a much better understanding of cider consumers and the Australian cider market, so as to ensure their marketing and brand positioning is as relevant and effective as possible.”