By Andy Young

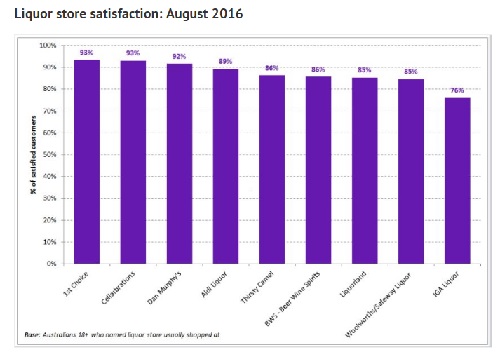

The latest Roy Morgan Customer Satisfaction Awards for the Liquor Store category, has First Choice on top with a score of just over 93 per cent.

The Awards, which are for the month of August, put First Choice less than one per cent ahead of Cellarbrations, also 93 per cent, while Dan Murphy’s is listed third on 92 per cent. The Liquor Store category within Roy Morgan’s Customer Satisfaction is extremely competitive, with the top eight separated by just eight percentage points.

Norman Morris, Industry Communications Director with Roy Morgan Research, said: “Overall, the country’s liquor retailers are doing a good job of keeping their customers satisfied, with most achieving satisfaction scores in the 90s and high 80s during August. We congratulate First Choice Liquor for excelling in such a competitive field.

As part of the data Roy Morgan uses to compile the results, the company asks consumers about different aspects of what is important to them in their liquor shopping. The result found that despite First Choice and Cellarbrations having a very similar score, the reasons their consumers are happy are different.

When asked which factors are most important to them when buying alcohol, the two groups reveal some strikingly different priorities. For example, being ‘located where I do other shopping’ is important to a substantially higher proportion of Cellarbrations customers (48 per cent) than First Choice customers (28 per cent); while ‘good value’ matters much more to First Choice customers (81 per cent) than those who shop at Cellarbrations (61 per cent).

Furthermore, the survey found that customers who usually shop at First Choice are far more likely than their Cellarbrations counterparts to consider a ‘good range’, ‘good weekly specials’ and a ‘good place for buying bulk purchases’ important when buying alcohol, whereas Cellarbrations customers place a higher priority on ‘helpful staff’ and the store being ‘close to home’.

With Dan Murphy's value and range win out over location as less than half of its customers (44 per cent) nominate ‘Close to home’ and less than a quarter (24 per cent) name ‘Located where I do other shopping’ as important factors when buying alcohol; instead ‘good value’ (84 per cent) and a ‘good range’ (55 per cent) are seen as more important to Dan's customers.

Morris added: “It’s interesting to note that there seems to be no guaranteed, gold-standard benchmark for satisfying a liquor shopper: different stores’ customers don’t necessarily value the same things when buying alcohol. Retailers must therefore understand what matters most to their customers and adapt accordingly, rather than simply follow another store’s example.

“The difference between what First Choice, Cellarbrations and Dan Murphy’s customers look for when shopping for booze is a case in point. Each chain may satisfy a similarly high proportion of their shoppers, but in each case, satisfaction appears to be driven by very different factors.

“Cellarbrations have made huge inroads in customer satisfaction over the last 12 months, even as their IBA stablemate IGA Liquor’s satisfaction levels have fallen. These shifting satisfaction levels appear to coincide with IBA converting its IGA Liquor outlets to Cellarbrations in WA, potentially signalling a new phase for both chains – we will certainly be monitoring them closely in coming months. Another one to watch will be Coles’ new low-cost alcohol venture, Liquor Market. How will Coles differentiate it alongside its existing alcohol brands, First Choice, Liquorland and Vintage Cellars – and how will customers respond? Only time will tell.

“With factors as diverse as store convenience, range of stock, price, staff and even store layout being of varying importance to different kinds of alcohol shopper, it is a challenge for bottle shops to hit on a winning formula for success. However, Roy Morgan’s comprehensive alcohol data can make the task easier, shedding light on the preferences, habits and attitudes of Aussie liquor buyers, and enabling retailers to convert this knowledge into higher levels of customer satisfaction.”

I’m skeptical, as Coles start a new discount brand to compete with Dans as 1st choice isn’t knocking off Dans from a reported 70% market share.

So if we took any weight from that survey then Coles would be better off dealing with the number of stores and locations..

Maybe 1st choice have the slightly higher customer satisfaction but they have around 1/3rd the customers.

Great if you want acres and acres of shelf space occupied by own brands and endless 2 for offers and bundle buys that look good until you see that on a 3 bundle, 2 are own brands with no real comparative price available. Looks like customers are surveyed on chain outlets in the main, which just perpetuates the race to the bottom of the quality tree.