The on-premise’s post-pandemic boom appears to be lessening, and customers’ spending habits are changing in response to rising economic pressures.

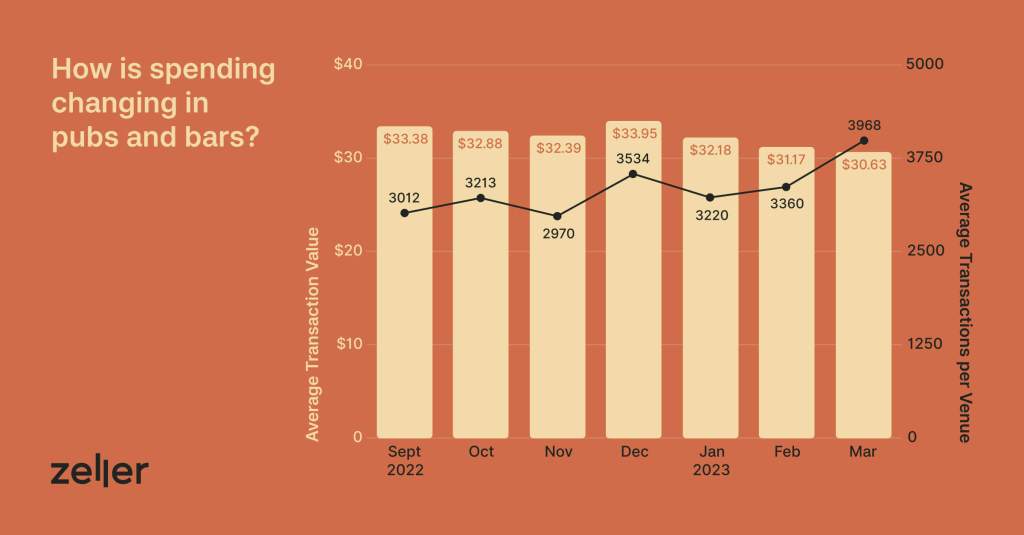

Data obtained by fintech company Zeller indicated that while more Australians are visiting the pub, average spend is down. Average transactions are at a high, at 3968 for March 2023, as compared to 3012 in September 2022. However, average spend is sitting at $30.63, steadily decreasing from December 2022’s $33.95. Joshua McNicol, Zeller’s director of growth, explained that this change is due to rising economic pressures causing customers to spend more cautiously.

“Across the thousands of Australian pubs, bars and venues that use Zeller Terminal, we’ve seen a shift over the past 6 months, which aligned to the economic mood and sensitivity of punters,” McNicol said.

In the day-to-day, this could look like customers opting for snacks rather than full-sized meals, or choosing a smaller drink size.

“This signals that the typical customer’s hip pockets are being hit by inflation, and makes it more important than ever that venue owners are tracking and understanding shifting consumer preferences, in order to remain competitive in the market,” McNicol added.

Nicholas Schultze, managing partner of Ascot Vale Hotel and Mona Castle Hotel, has certainly noticed a change in the kinds of orders he is seeing at his venues. In the immediate post-lockdown period, customers were ordering a large quantity per table, generally opting for traditional pub favourites. Now, customers are ordering less, and seeking out specials.

“We are seeing this behaviour change to ordering one or two items at a time, whether a meal special, or a more high-end beer or wine we are doing for a reduced price in collaboration with a local brewer or winery,” Schultze described.

Marketing specials on social media and through bar front signage has proven effective as customers are seeking value. Schultze has also has success with point-of-sale analytics.

“The reporting and analytics from Zeller has assisted us in dissecting our patrons median spend on a monthly basis and allows us to tailor more specific food and beverage specials,” Schultze explained.

Another area of change is in population demographics, particularly for inner-city venues.

“Previously people would religiously come down to local’s nights, but with changing demographics in the areas, we are seeing this shift. It has become more scattered, with many in the area feeling the pinch with interest rate rises, and growing house prices in inner Melbourne. The younger demographics purchasing property in the area are finding it harder to include weekly pub meals in their budgets, so we are seeing more people than previously, but they are coming in more sporadically,” said Schultze.

Though customers are spending less, the continued increase in total sales is positive for the on-premise. Understanding the changing preferences and needs of customers can help publicans make the most of the current economic situation.

Thanks for this post as it comes with useful details.