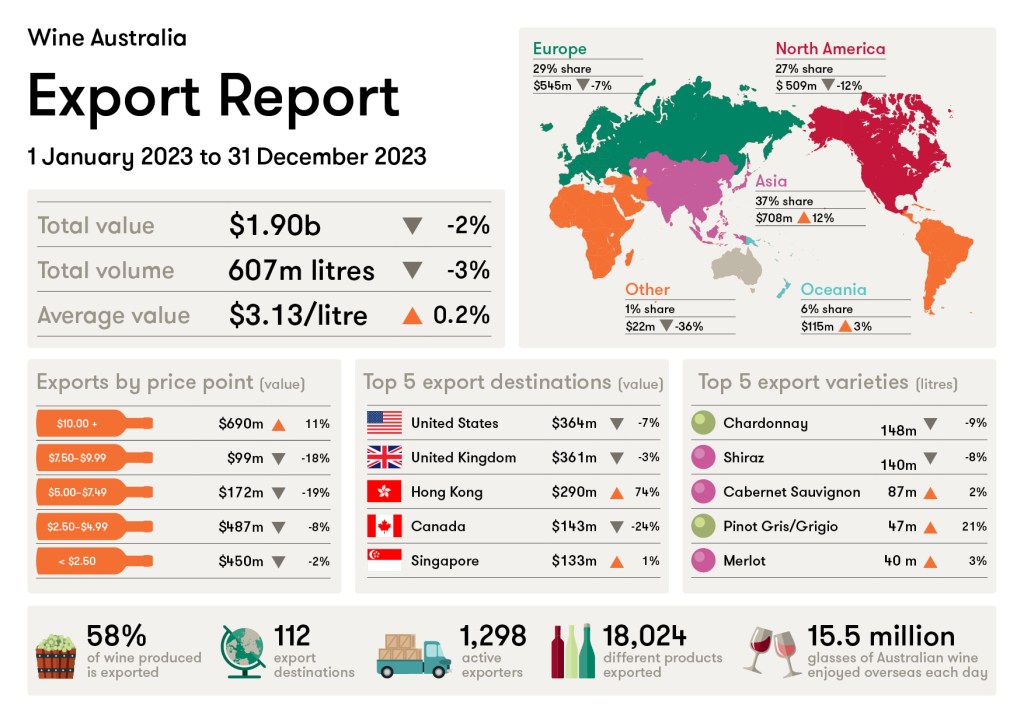

In new data released by Wine Australia, it was reported that Australian wine exports saw a decline of two per cent in value to $1.90 billion, and three per cent in volume to 607 million litres, in the 12 months to December 2023.

As the global alcohol market softens, the declining Australian export market is following global trends, with most wine producing countries reporting a decrease in sales and exports.

Despite an improvement on figures reported in September 2023, the results sit below long-term averages and reflect challenging global trends, with IWSR research also pointing to a “significant negative shift” in spending on alcohol, caused by “economic moderation”.

Wine Australia Manager – Market Insights, Peter Bailey, explained that the reduction in Australia’s export value in 2023 was led by Europe and North America, whose exports declined by seven and 12 per cent respectively.

“In Europe, exports to the top 15 markets declined in value as the region suffers through higher inflation rates than North America and Asia, as well as supply chain issues. This included United Kingdom, Australia’s largest export market by volume. Pleasingly, Australia’s exports to the UK grew in volume for the first time since mid-2021.

“Both the United States and Canada contributed to North America’s decline in value. In 2023, packaged shipments to these markets continued their decline and unpackaged shipments, which were growing strongly, have started to ease off.”

Despite the rate of decline, down seven per cent in value to $364 million, the United States remained the top market by value, holding 19 per cent share of total export value, and the second key market by volume.

Also holding 19 per cent share of total export value is the United Kingdom, down three per cent in value to $361 million, but up two per cent in volume to 220 million litres, representing 36 per cent share of total export volume.

“The decline in exports to Europe and North America has resulted in their share of export value dropping to 29 and 27 per cent respectively. Meanwhile, Asia’s share of export value has grown to 37 per cent,” added Bailey.

“Hong Kong and Singapore were stand out destinations for Australian wine in Asia, driving the growth of value to the region. Further, the number of exporters to Hong Kong also grew – up 138 export businesses to a total of 531 in 2023. Hong Kong and Singapore are key trading hubs in the Asian region, and, as such, some the wine is on-shipped to other markets.”

Hong Kong became the third top market by value, up 75 per cent to $290 million and now representing 15 per cent share of total export value, followed by Canada at eight per cent share and Singapore at seven per cent share.