Australia’s largest independent beverage wholesale platform, eBev, has launched debtor financing solutions in partnership with Cirralto and its Spenda B2B payment platform.

This new capability will allow eBev to expand early payment to suppliers, and the ability to pay suppliers in three days. The partnership also opens the door for potential development into the lucrative Buy-Now, Pay-Later (BNPL) market by eBev’s Trade platform. The debt financing transactions will funded by Cirralto through its subsidiary, Invigo.

The Chief Commercial Officer of Spenda, Andy Hilton, said: “eBev’s position as Australia’s largest and most advanced marketplace in the $8bn wholesale beverage industry makes it best placed to deliver working capital to a COVID ravaged landscape.”

“Spenda’s unique dynamic financing solution will enable eBev and its customers to grow quickly without having to worry about working capital.”

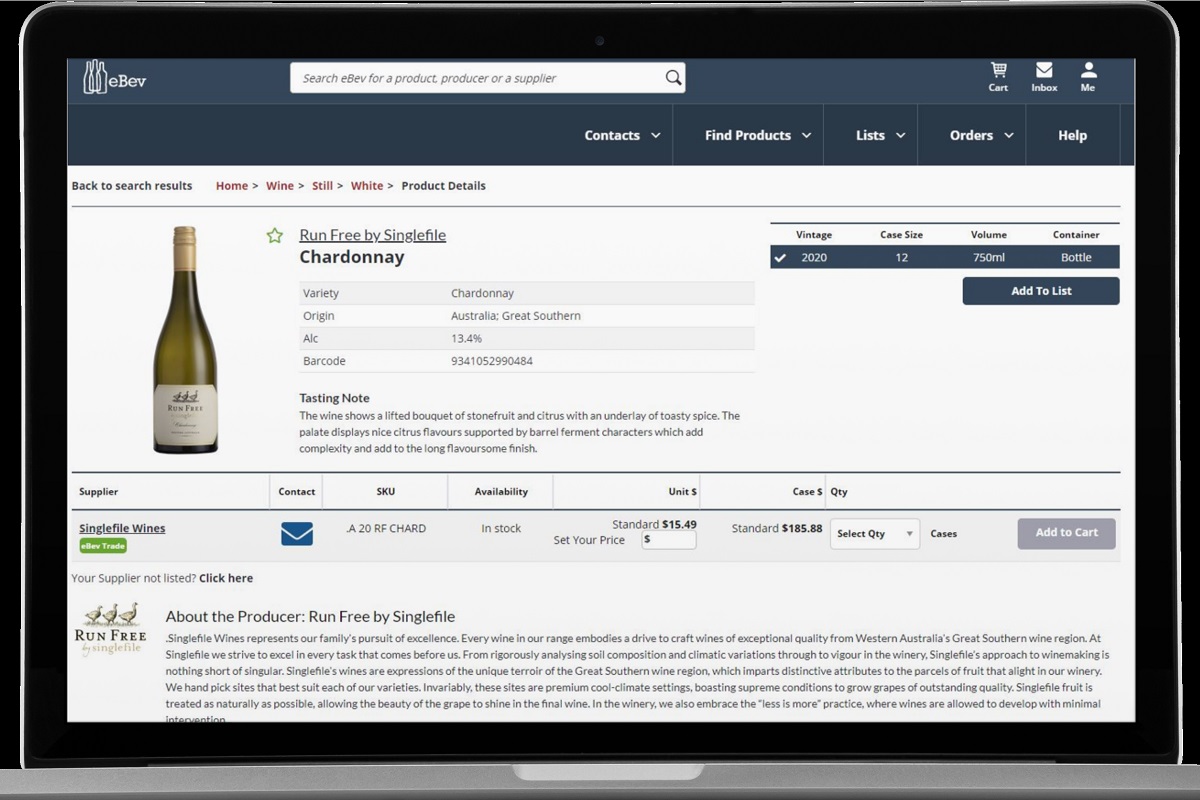

eBev, which was founded in 2015, reduces credit risk to beverage suppliers by guaranteeing payment within three days. For hospitality customers, the platform consolidates ordering, invoicing and payments in one place, streamlining the process.

As of 2021, eBev is processing over $150m of annual orders, and can count over 12,000 licensed premises among its customers. The platform believes this partnership will provide eBev with ‘an unparalleled growth runway’. The company plans to float on the ASX in 2022.

The platform is backing up its tech expansions with new hires from the Fintech sector, announcing a new Head of Product and Technology, Atul Narang, and a new Chief Financial Officer, Zoran Grujic. eBev Chief Executive Officer, Ian Harris, said: “In the last few weeks we have brought in Atul Narang to expand our capability in the fintech space which is critical to our growth.”

“A significant part of setting the business up for the future is bringing in an ASX experienced CFO. We are pleased to announce that after a few months of advising the business, Zoran Grujic has joined the team to build out that capital strategy on the path to listing on the ASX next year.”