Over the past decade tequila has enjoyed high levels of consumer demand, becoming a major success story in the global spirits market much like gin. Despite strong performance for both categories, data published by the IWSR reveals that tequila is now outstripping gin in growth terms.

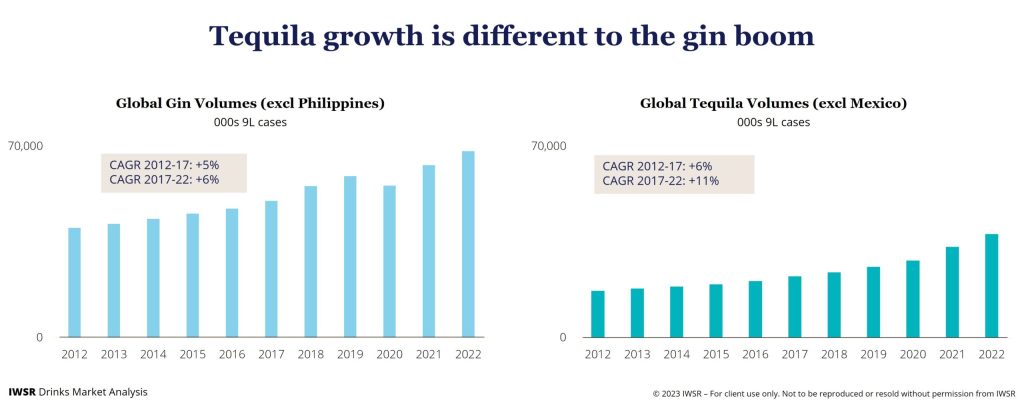

According to IWSR figures, global gin volumes grew at a CAGR of +five per cent between 2012 and 2017, and +six per cent between 2017 and 2022. While tequila showed similar performance between 2012 and 2017 when global volumes rose at a CAGR of +six per cent, this accelerated to +11 per cent between 2017 and 2022.

This contrast is also reflected in the IWSR’s growth forecast for the two spirits, with gin expected to grow at a CAGR of +three per cent between 2022 and 2027, while tequila is expected to grow at a volume CAGR of +nine per cent over the same period.

The IWSR predicts that tequila will continue to expand at a faster rate than gin and for a sustained period of time, attributing these expectations to five major differences between the two categories.

Market dynamics

While the gin category is well established in a number of countries and demonstrates geographical diversity, IWSR figures show that growth for the spirit has now run its course in its key markets of the UK and Spain.

Tequila’s growth is much less geographically diverse with the US market accounting for over 60 per cent of global volumes and remaining the number one priority for most brand owners.

Alongside this, agave spirits are now experiencing dynamic growth in a number of countries globally, with IWSR data revealing that 15 of the 20 largest agave spirits markets experienced growth volume of more than 20 per cent in 2022. Of those 20 markets, 14 are expected to see agave spirits volumes grow at a CAGR of above +five per cent between 2022 and 2027.

José Luis Hermoso, IWSR Research Director Central and South America, said: “Tequila producers are likely going to continue to invest most of their time in the US market, where they can more easily sell their products with better margins, compared to other countries.

“There is definitely demand for tequila in other markets that has not been satisfied, but the category needs to be built in many other countries that have the potential, but not yet the consumer interest and knowledge, for tequila to move forward; this will probably not happen until a slowdown in US demand is confirmed.”

Product type

Global growth of the gin category has relied heavily on product innovation, which according to the IWSR has revived what had become a rather jaded category. Within the category we have seen a craft movement and diversification of the product to maintain consumer interest such as flavoured expressions.

The IWSR says that the vast majority of gins have relied on cues such as packaging and ingredients to persuade customers to trade up to a more expensive contrast.

By its nature, tequila is a product which offers much greater diversity without relying on innovation. When it comes to aging, there are five different types of tequila (blanco, reposado, añejo, extra añejo, and cristalino) which naturally impart different characteristics.

Provenance and authenticity

Gin has often leaned into its credentials of being locally distilled or using locally sourced ingredients and botanicals as a means of promoting authenticity. While demand for authenticity is high, tequila is much better positioned to promote provenance cues due its production being confined to a legally restricted geographical area.

Hermoso explained that it is much easier for tequila to play the provenance and authenticity card than it is for gin.

“Tequila has to be produced in Mexico, whereas gin can be made anywhere. I think there is no doubt that provenance and authenticity are important factors for consumers in many markets today.”

Price range

The pricing of tequila spans a range much broader than gin, with differences in product type and provenance credentials supporting growth of the super-premium and premium-and-above price points in the US market.

Hermoso said: “Tequila is much more present than gin at the very high end (prestige and prestige-plus, status spirits), simply because its liquid and ageing classification justify, in some cases, very high pricing – and this is accepted by consumers.

“However, gin – which is usually non-aged – has relatively less to offer in order to be accepted as a prestige spirit with similar status to Cognac, single malt or high-end tequila.”

Consumption occasions

The IWSR states that gin’s continued growth has largely been built on the popularity of the aperitivo and early evening occasion, feeding into consumer preferences for lighter drinks and lower ABVS.

Tequila was often seen as a late-night option, especially in the on-premise, but in recent years the category has repositioned itself thanks to the dominance of ultra-premium tequilas within the category.

Tequila is a versatile spirit that lends itself to a diverse range of consumption occasions, from popular cocktails such as the Margarita, which is currently experiencing a surge in popularity on-premise, to high-end sipping.

“The fact that tequila can be consumed neat or mixed, depending on the occasion, consumer and quality of the liquid, is an advantage,” says Hermoso.

“Even the brands that initiated the gin revival 20 years ago are consumed mixed, as are flavoured gins, and little or no gin is sipped or consumed on the rocks as most very high-end spirits are. This also tends to justify the higher price points tequila is able to command.”

Navigating the markets

The IWSR suggests that tequila brand owners can learn from gin’s growth curve by observing emerging tequila markets outside of the US and Mexico, which will eventually provide opportunities to build on tequila’s momentum globally.

With restrictions on tequila sourcing, other agave and agave-adjacent categories are also tipped for growth as other countries begin to plant agave plants locally and take inspiration from Mexican traditions.

The gin category is still expected to grow, albeit at a slower rate than previous years, but the IWSR suggests that producers will need to communicate clear points of differentiation to stand out in a saturated market as well as looking to portfolio rationalisation.