By Peter Bailey, Market Insights, Wine Australia

The Nordic countries of Sweden, Finland and Norway offer growth opportunities for Australian wine exports and, unlike some of the traditional European markets, they are generally quite open to wines from around the world.

Growing winegrapes is difficult due to cold weather and the low number of winter sunlight hours. As a result, Nordic countries do not have significant domestic wine production and wine is primarily imported. Additionally, there is no strong preference for a specific style of wine, which offers opportunities to producers of both traditional and alternative wines.

The wine markets are controlled by the state monopolies of Systembolaget (Sweden), Alko (Finland), and Vinmonopolet (Norway). These monopolies control the entire off-trade in their respective countries (431 retail stores in Sweden, 350 in Finland and 301 in Norway) and the off-trade has 90 per cent of the market share.

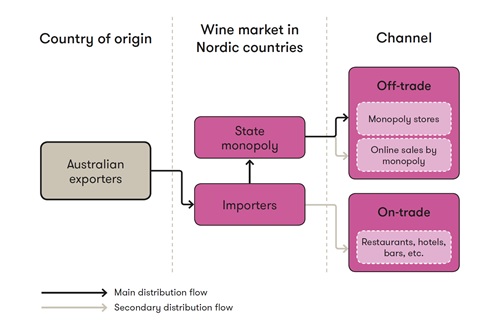

The figure below demonstrates the distribution of wine.

These Nordic monopolies use a tender system to buy wine for their stores. Importers are notified several times a year about detailed tender requests. Wine type, region of production and price per unit are examples of items specified in a tender. The monopolies also regularly request tenders for small volumes, which could be of interest for new and smaller producers in Australia.

The on-trade is very competitive and requires marketing support from importers, which often need to offer discounts to gain or retain interest from their customers. There are many buyers in the on-trade that require small volumes of premium wine. For producers with only small volumes of premium wine available, the on-trade may provide better opportunities than the off-trade. Whether supplying the off-trade or on-trade, wine producers need to engage an importer or sales agent.

Importers in Nordic countries face strong competition from small-scale tax-free ferry trade between the Nordic countries, Germany and the Baltic states. These sales are not included in the official sales statistics, because officially the wine is not sold in any of the Nordic countries. The value of this trade is estimated at around €100 million. Due to high excise duties and the subsequent price of wine in Nordic countries, many consumers and small-scale traders purchase their wine in neighbouring countries or on board ferries where prices are lower. They can bring in up to 90 litres a time, largely by ferry, to the Nordic countries.

All Nordic monopolies strongly push for ethical and sustainable wines. One element of concern in these markets is the feeling among consumers that wines from Australia (and New Zealand) are more costly to the environment due to the distance they need to travel. To offset this concern, 63 per cent of Australian wine exported to the Nordics is sent in bulk containers and then packaged in-market.

Sustainability concerns and the promotion of recyclable packaging have contributed to a strong presence of Bag in Box in the Nordics. Currently, around 50 per cent of wine in the Swedish and Norwegian markets and 40 per cent in the Finnish market is packaged as Bag in Box. Lower handling fees per litre for boxed wine than for bottled wine has also added to the success of Bag in Box.

The Swedish wine market is by far the biggest and most mature of the three Nordic markets (24 million cases annually). Per capita wine consumption is approximately 25 litres, which is similar to the per capita consumption in Germany. In Norway and Finland, total consumption amounts to 8 million and 7 million cases respectively. Per capita wine consumption of 16 litres in Norway and 11 litres in Finland suggests a greater upside in these two markets.

The Swedish wine market is flat and Australia sits at number five in market share, with Australian wine sales slightly in decline. The monopoly dominates sales and aims to grow the organic wine market share by 25 per cent over the next few years. Swedes are open-minded, like to experiment and welcome wines from many different countries. One of Wine Australia’s goals is to grow our market share in the on-trade through engagement with the importers, the market segment not controlled by Systembolaget.

The Norwegian market is relatively small but growing and Australia currently ranks sixth for market share. It’s important for Wine Australia to build on its activities and increase share by developing a deeper understanding of trade, media and consumers of Australian wine. Norwegian consumption patterns are much more traditional; consumers show less interest in New World wines and tend to choose known wines from Old World origins.

Finland is part of the Vodka belt and although vodka still accounts for about a quarter of alcohol consumption, the share of vodka and other spirits has decreased markedly in recent years. At the same time, there is a growing interest in wine. The Finnish market is in growth and Australian wine, currently sixth for market share, is also in growth. Finland is increasingly enthusiastic about the Australian category and consumers are keen to learn more about our wines. Wine Australia’s goal is to grow market share in both the on-trade through engagement with importers and sommeliers, and the off-premise via the monopoly.

In late September and early October, Wine Australia held the Nordic Roadshow encompassing master classes, and trade and consumer tastings in Finland, Denmark, Norway and Sweden. For more information on the Nordic markets, contact Wine Australia’s UK and Europe team at europe@wineaustralia.com.