The spirits industry is again calling on the Government to reform Australia’s untenable spirits excise regime following the release of the Mid-Year Economic and Fiscal Outlook (MYEFO).

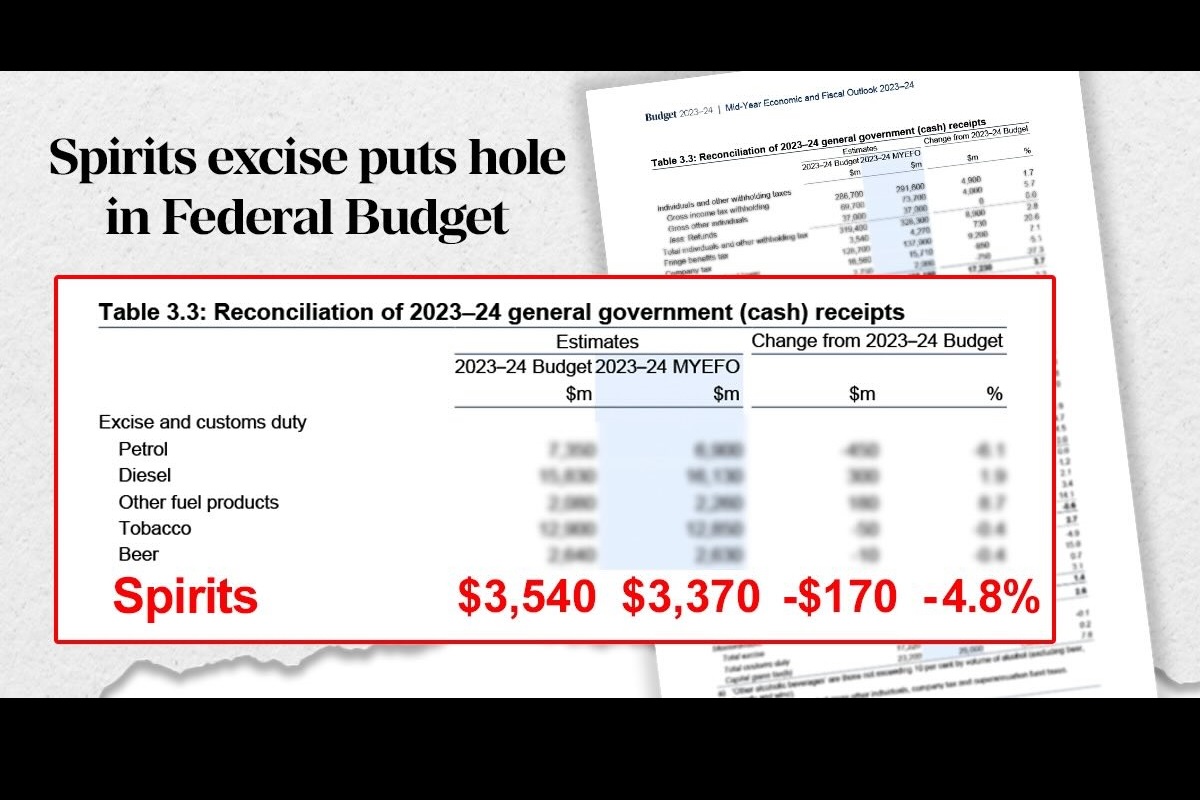

The MYEFO is projecting a $170m shortfall in revenue from spirits excise in 2023-24, with the combination and high spirits excise and inflation continuing to hit consumer pockets and demand.

Spirits and Cocktails Australia chief executive Greg Holland says the budget update confirms the pain that is currently being felt among spirits manufacturers.

“Declining spirits sales are now being reflected in the Federal Government’s tax coffers,” he said.

“This lower tax revenue is despite spirits excise having recently hit at an all-time high of $100.05 per litre of alcohol.”

According to Holland spirits tax in Australia has reached a similar tipping point to that experienced in the UK earlier this year, with spirits sales falling by 20 per cent immediately following an unprecedented 10.1 per cent duty rise in August.

The UK government found the tax increase contributed to the largest rise in UK inflation ever recorded and lower tax revenue.

“With another excise increase for the Australian spirits industry due in February, we call on the Federal Government to follow the UK’s lead and better align alcohol taxation to the current economic conditions,” Holland said.

“The rate of spirits excise has increased, yet revenue is down. This tells us everything we need to know about the appropriateness of this tax in the current economic climate.”

As well as hurting the Budget, Australian Distillers Association CEO Paul McLeay said Australia’s flawed spirits taxation system was putting the country’s emerging spirits industry as risk.

“We now have more than 600 distilleries operating in all corners of Australia, the majority of which are in regional areas, contributing 5000 manufacturing jobs to the Australian economy,” he said.

“Spirits excise in Australia has risen by a total of 12.5 per cent in under two years, fuelling inflation and cost of living pressures on hard working Australians.

“As consumption is falling our spirits producers are also being hit with higher costs of production, and now they are facing another excise hike in February.

“We call on the Government to ease the pressure on the Australian industry by freezing spirits excise.”