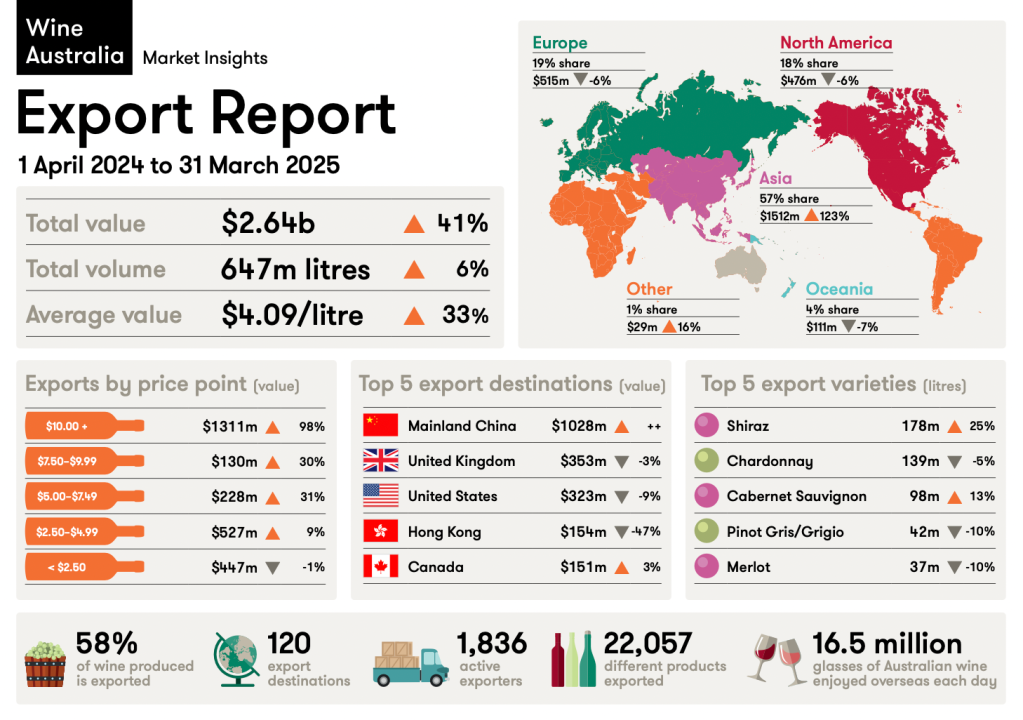

In the 12 months to March 2025, Australia exported 96 million litres of wine valued $1.03bn to the Chinese market after trade tariffs were removed.

The Wine Australia Export Report showed it is not all good news though, with exports to the rest of the world declining by 13 per cent in value to $1.62bn and 9 per cent in volume to 551 million litres.

Wine Australia’s Market Insights Manager, Peter Bailey, said the increase in average value is mainly due to the elevated level of premium wine shipments to mainland China, after tariffs on Australian bottled wine were removed at the end of March 2024.

“While the total value of shipments to mainland China is now at a similar level to the years immediately before tariffs on Australian bottled wine came into force, volume in the last 12 months is 23 per cent smaller than the five-year average between 2016 and 2020 and 44 per cent below the peak in 2018,” he said.

“The average value of packaged wine shipped to mainland China was $23 per litre, much higher than any other major export market.

“The lower volume and high average value demonstrate that mainland China is a premium market for Australian wine and will therefore not solve oversupply issues in Australia.”

The report showed the global wine market is facing considerable challenges headwinds which are impacting on results for other markets aside from mainland China and will not likely be resolved soon. It also raised concerns about a 47 per cent reduction in exports to Hong Kong.

There are concerns about US tariffs affecting the industry and a long-term trend of consumers drinking less alcohol in addition to cost-of-living pressures may yield poorer results in some markets for years to come.

“Escalating trade wars have the potential to increase prices, complicate supply chains, and rapidly change the competitive landscape in key wine markets in the near-term,” the report stated.

“On 2 April 2025, US President Trump announced tariffs on all importing countries, including Australia.

“However the situation is evolving and there is still a lot of uncertainty about what the longer-term position might be.”

Australian wine exports in the last year to the US declined by 17 per cent in volume to 106 million litres and 9 per cent in value to $323 million, its lowest levels since the early 2000s.

Exports to the UK declined by 8 per cent in volume to 208 million litres and 3 per cent in value to $353 million but despite the decline, the number of exporters shipping to the UK increased to 314 businesses, up by 23 from the previous 12 months.

Top Five by value

Mainland China – up $1.01bn to $1.03bn

UK – down $12m to $353m

US – down $32m to $323m

Hong Kong – down $136m to $154m

Canada – up $3.8m to $151m

Top Five by volume

UK – down 19m litres to 208m litres

US – down 21m litres to 106m litres

Mainland China – up 94m litres to 96m litres

Canada – down 14m litres to 60m litres

New Zealand – down 3.5m litres to 26m litres